🚜Tractor Loan EMI Calculator

How to Use the Tractor Loan EMI Calculator?

- Choose the amount that you need for your tractor

- Enter the interest rate offered to you

- Select a convenient loan tenure

- Press the ‘Calculate EMI’ button.

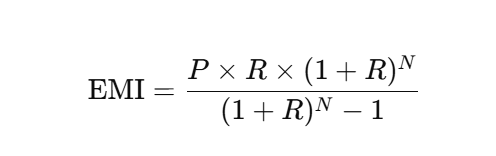

EMI Calculation Formula Explained

Here, P, R, and N are the key variables. This means the EMI amount will vary each time you adjust any of these three. Let’s understand them in detail:

- P refers to the Principal Amount — the original loan amount provided by the bank, on which the interest is calculated.

- R stands for the Rate of Interest determined by the bank.

- N represents the Number of Years allotted for loan repayment. Since EMIs are paid monthly, the tenure is converted into the number of months.

For Example: Suraj Mal Thakur has bought a tractor worth 15 lakhs and he had taken a tractor loan of Rs 10 lakh at an interest rate of 12%, for period of 2 years

the approximate EMI will be:

- P = Rs 10,00,000

- R = 12 ÷ 12 ÷ 100 = 0.01 (or 1%)

- N = 2 years or 24 months. as per the formula

- EMI = Rs 47,073.

FAQs

Q1. What is a Tractor Loan EMI Calculator?

A. A Tractor Loan EMI Calculator is an online tool that helps you calculate the monthly installments (EMIs) you need to pay for a tractor loan based on the loan amount, interest rate, and tenure.

Q2. Can I use this calculator for any type of tractor loan?

A. Yes, it can be used for new, used, or refinancing tractor loans offered by banks, NBFCs, or agricultural financing institutions.

Q3. Can I change the values to compare different scenarios?

A. Absolutely. The calculator is interactive—you can adjust the loan amount, tenure, or interest rate to instantly see how your EMI changes.

Q4. Will this calculator work on mobile devices?

A. Yes, it is fully responsive and can be accessed easily on smartphones and tablets.

Q5. What is the age limit for tractor loan?

A. The borrower must be at least 18 years old and no older than 70 years at the time of the agreement. If the borrower is over 70, a family member (blood relative or legal heir) can be included as a co-applicant.