💰 Working Capital Loan Calculator

A Working Capital Loan Calculator helps businesses estimate their monthly repayment amount when taking a loan to cover short-term operational needs. It’s a quick and efficient way to understand repayment obligations before applying for a loan.

💡 Why Use This Calculator?

- Plan Your Cash Flow – Ensure you can comfortably manage repayments without affecting daily operations.

- Compare Loan Offers – See how different interest rates, amounts, and tenures affect monthly payments.

- Avoid Surprises – Get a clear picture of the total interest payable and loan cost in advance.

- Make Informed Decisions – Choose the right loan structure for your business’s financial health.

📍 Where to Use It?

- Small and Medium Businesses (SMBs) – To fund inventory purchases, payroll, or expansion.

- Seasonal Businesses – To manage expenses during off-peak periods.

- Startups – To bridge gaps between expenses and incoming revenue.

- Any Business with Cash Flow Gaps – To keep operations running smoothly without financial strain.

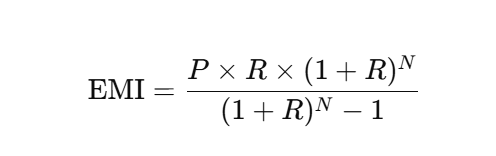

EMI Calculation Formula Explained

Where:

- P = Loan Amount

- R = Monthly Interest Rate

- N = Number of Monthly Installments

FAQs

Q1. What is a Working Capital Loan Calculator?

A. A Working Capital Loan Calculator helps businesses estimate the monthly EMI for loans taken to manage day-to-day operational expenses. It factors in the loan amount, interest rate, and repayment tenure.

Q2. Who should use this calculator?

A. Business owners, entrepreneurs, and financial managers looking to fund short-term operational needs like inventory, payroll, or rent can use this tool to estimate repayment.

Q3. What all information do I need to use the calculator?

A. You’ll need:

a. Loan amount (principal)

b. Annual interest rate

c. Loan tenure (in months or years)

Q4. Does the calculator include processing fees or taxes?

A. No. It only provides EMI based on loan terms. Actual costs may vary depending on lender-specific charges like processing fees, prepayment penalties, or GST.