🔹Introduction

If you’ve ever taken a Home loan, car loan, or any personal loan, you’ve probably wondered how your monthly EMI is calculated or how long it will take to pay it off completely. That’s where an Amortization Calculator comes in. It helps you understand your loan repayment schedule in a clear and detailed manner.

In this blog, we’ll break down what amortization means, how the calculator works, and walk you through a simple formula with an example so anyone — even with no math background — can understand it.

🔹What is Amortization?

Amortization is a way of paying off a loan through regular monthly payments. Each payment goes toward two things:

- The principal: the amount you actually borrowed.

- The interest: the cost of borrowing that money.

In the beginning, more of your monthly payment goes toward interest. But over time, as the loan balance gets smaller, more of your payment goes toward the principal. This gradual shift is what amortization is all about.

🔹What is an Amortization Calculator?

An Amortization Calculator is an online tool that helps you:

- Calculate your monthly EMI.

- Break down each payment into interest and principal.

- Generate a full loan repayment schedule.

- See the total interest paid over time.

It’s extremely useful for anyone planning a loan or managing current debt — whether for buying a house, a car, or any other big expense.

🔹How Does It Work?

To use an amortization calculator, you just need to enter three basic inputs:

- Loan Amount (Principal) – The total money you are borrowing.

- Interest Rate (Annual) – The rate at which interest will be charged.

- Loan Term (in months or years) – The total duration to repay the loan.

Once entered, the calculator will instantly show:

- Your monthly payment (EMI).

- A month-by-month breakdown of how much goes to interest vs. principal.

- The total interest paid across the loan term.

🔹The Amortization Formula

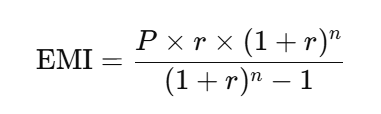

Most calculators use a standard EMI formula to compute monthly payments:

Where:

- P = Principal loan amount

- r = Monthly interest rate (Annual rate ÷ 12 ÷ 100)

- n = Number of monthly payments

🔹Example: Let’s Make It Simple

Let’s say Arvind borrows ₹1,00,000 at 10% interest per year for 5 years.

- P = ₹1,00,000

- Annual Interest = 10%, so monthly interest r = 10 ÷ 12 ÷ 100 = 0.00833

- n = 5 years = 60 months

Plug into the formula:

So you’ll pay ₹2,124.70 every month for 60 months.

- Total payment = ₹2,124.70 × 60 = ₹1,27,482.27

- Interest paid = ₹1,27,482.27 − ₹1,00,000 = ₹27,482.27

🧮 See your loan repayment schedule in seconds.

Use our free Amortization Calculator now.

🔹Why Use an Amortization Calculator?

Here are some clear benefits:

- ✅ Plan your monthly budget confidently.

- ✅ Visualize your full payment schedule.

- ✅ Know how much goes to interest vs. principal.

- ✅ Make smarter financial decisions.

- ✅ Decide if early payments will save you money.

🔹Final Thoughts

An amortization calculator isn’t just a numbers tool — it’s a financial planning assistant. It helps you fully understand your loan, prepare better, and avoid surprises.

Whether you’re planning to take a loan or already paying one off, using this calculator gives you complete clarity about your debt journey. The earlier you understand how amortization works, the better equipped you’ll be to manage your money.

🎯 Who Should Use This Tool?

This tool is helpful for:

- Home buyers

- Car loan applicants

- Education loan planners

- Personal loan comparisons

- Anyone planning to understand loan costs and structure

FAQs

Q1. What does amortization mean in simple terms?

A. It’s the process of paying off a loan through regular monthly payments that include both interest and principal.

Q2. Why does my interest amount go down over time?

A. Because the loan balance is reducing every month, and interest is calculated on that reducing balance.

Q3. What is the purpose of an amortization calculator?

A. To calculate your monthly EMI and show a full repayment schedule, including how much goes toward interest vs. principal each month.

Q4. Is amortization the same as EMI?

A. Not exactly. EMI is the monthly payment amount. Amortization refers to how that EMI is split between interest and principal over the loan term.

Q5. Will it help if I pay more than the EMI?

A. Yes! Paying extra (especially early) reduces the principal faster, which lowers the interest charged and shortens your loan term.

Q6. Can amortization help me save money?

A. Yes! By looking at your amortization schedule, you can plan to make extra payments early in the loan term — which reduces your principal faster and saves you money on interest.