🧾 Introduction

When shopping for a loan or credit card, you’ll come across two important numbers: the interest rate and the APR. Most people only focus on the interest rate—but that can be misleading.

The APR (Annual Percentage Rate) shows you the full cost of borrowing, including interest and fees. In this post, we’ll break down what APR really means, how it’s calculated, and how to use our free APR Calculator to make smarter decisions.

💡 What is APR (Annual Percentage Rate)?

APR stands for Annual Percentage Rate, which is the total yearly cost of a loan expressed as a percentage. It includes:

- Interest rate

- Loan origination fees

- Processing charges

- Any other required costs

It’s meant to give borrowers a standardized way to compare different loan offers, regardless of how lenders structure their fees.

🤔 Why is APR Important?

When comparing two loan offers:

- Loan A: 10% interest, ₹3,000 fees

- Loan B: 10.5% interest, no fees

At first glance, Loan A looks better. But if you calculate APR, you might find Loan B is cheaper overall.

So, always compare APR, not just interest rates.

How Is APR Calculated?

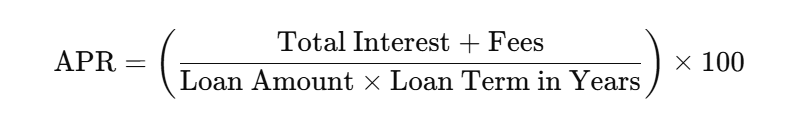

APR is not always simple to calculate manually. Lenders often use the IRR (Internal Rate of Return) formula over the loan’s term. A simplified version looks like this:

🔢 APR Formula (Basic Estimation):

✍️ Example:

Let’s say Navin you took a loan of ₹50,000 at a 10% interest rate for 1 year with a ₹2,000 processing fee.

Plug into the formula:

So you’ll pay ₹4,395.79 every month for 12 months.

- Total payment = ₹4,395.79 × 12 = ₹52,749.53

- Interest paid = ₹52,749.53 − ₹50,000 = ₹2,749.53

- APR (Annual Percentage Rate): 17.79%

🧮 Want to calculate your real loan cost?

Use our free APR Calculator now.

Why Does APR Matter?

- Transparency: It shows the full cost of the loan.

- Comparison: Helps compare loans from different lenders fairly.

- Smart Borrowing: Prevents surprises from hidden fees.

🎯 Final Thoughts

Understanding your APR is crucial when borrowing money. It goes beyond just the interest rate and shows the real cost of your loan by including fees and charges. Always compare APRs, not just interest rates, before deciding on a loan. Use our APR Calculator to make smarter, transparent, and well-informed financial choices.

FAQs

Q1. What is APR and why should I care?

A. APR tells you the real yearly cost of a loan, including all charges. It helps you make fair comparisons.

Q2. Is APR always higher than the interest rate?

A. Yes. Since APR includes fees and interest, it’s usually higher than the interest rate.

Q3. Is APR relevant for credit cards too?

A. Yes! Credit cards also have APRs, which can vary by how you use the card (purchases, cash advances, etc.).

Q4. Can I negotiate APR with the lender?

A. You can sometimes negotiate fees or rates — which in turn lowers the APR.

Q5. Is APR used for all types of loans?

A. Yes. APR applies to mortgages, car loans, personal loans, and credit cards. It’s a standardized way to compare the cost of borrowing.

Q6. How is APR different from EMI?

A. EMI is your monthly repayment amount, while APR is the yearly cost of your loan as a percentage.