Mahila Samman Savings Certificate Calculator

The Mahila Samman Savings Certificate (MSSC) is a government-backed savings scheme launched exclusively for women and girls. It offers a fixed interest rate and assured returns, making it a great short-term investment option.

Who Can Use This Calculator?

- Women interested in safe, short-term investment options.

- Parents or guardians investing in the name of a girl child.

- Anyone planning savings for education, marriage, or emergency funds.

Steps to Use the MSSC Calculator:

- Enter the investment amount (₹1,000 to ₹2,00,000).

- The calculator automatically applies the 7.5% interest and 2-year term.

- Click on Calculate

- View your total maturity amount and interest earned instantly.

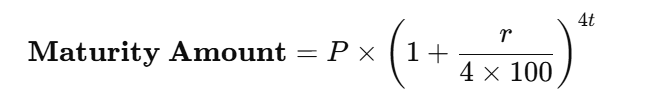

Formula to Calculate Maturity Amount:

Where:

- P = Principal (initial investment)

- r = Annual interest rate (7.5%)

- t = Time in years (2 years)

If Riya invests ₹2,00,000 in MSSC for 2 years so after 2 years Riya earns ₹31,436 as interest

FAQs

Who is eligible for MSSC?

Any Indian woman or guardian of a girl child can open this account.

Is the interest earned taxable?

Yes, interest is taxable as per your applicable income tax slab.

Can I invest more than ₹2 lakh?

No, the maximum limit per individual is ₹2,00,000.

Where can I open an MSSC account?

You can open it at authorized post offices or nationalized banks.

Is there any age limit to open the account?

No specific age limit for women. For girl children, accounts are managed by a guardian.

Can I extend the scheme beyond 2 years?

No, the Mahila Samman Savings Certificate has a fixed tenure of 2 years and cannot be extended.

Is nomination facility available under MSSC?

Yes, you can add a nominee at the time of account opening or anytime later.

What is the mode of payment while investing in MSSC?

You can deposit through cash, cheque, demand draft, or electronic transfer at the post office or authorized bank.

Will I receive a certificate for this investment?

Yes, a Mahila Samman Savings Certificate will be issued after successful deposit and account creation.

What is the tenure of the Mahila Samman Scheme?

The tenure of the Mahila Samman Scheme is two years.