💰 APR Calculator – Annual Percentage Rate

What is an APR Calculator?

An APR (Annual Percentage Rate) Calculator helps you calculate the true yearly cost of a loan, including the interest rate plus any additional fees like processing charges, closing costs, or service fees. This makes it easier to compare loan offers from different lenders.

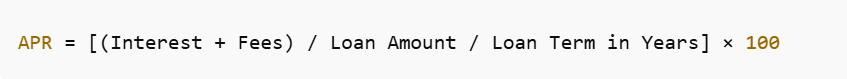

APR Calculation Formula Explained

Where:

- Interest = Total interest paid over the life of the loan

- Fees = Additional costs (e.g. processing fee, service charge)

- Loan Amount = Principal amount borrowed

- Loan Term = Duration of the loan in years

Who Should Use This Calculator?

- Individuals comparing personal loans, car loans, or home loans

- Credit card users trying to understand their actual cost

- Financial advisors or consultants

- Students evaluating education loans

- Small businesses reviewing business loan offers

Other Finance Tools

- Car Loan EMI Calculator

- Depreciation Calculator

- FD Calculator

- Home Rent Allowance Calculator

- Mahila Samman Savings Certificate Calculator

- Simple Interest Calculator

- Systematic Withdrawal Plan Calculator

FAQs

How is APR different from interest rate?

The interest rate is the cost of borrowing the principal loan amount. APR includes the interest rate plus additional loan-related fees, giving a more accurate view of the total borrowing cost.

Why should I use an APR Calculator?

An APR Calculator helps you:

a. Understand the true cost of a loan

b. Compare loan offers accurately

c. Avoid misleading low interest rates with high fees

What information do I need to calculate APR?

You’ll need:

a. Loan amount

b. Interest rate

c. Loan term

d. Fees (processing, closing costs, etc.)

Does APR change over time?

For fixed-rate loans, APR remains constant. For variable-rate loans, APR can fluctuate based on changes in interest rates and fees.

Is APR used for all types of loans?

Yes. APR applies to mortgages, car loans, personal loans, and credit cards. It’s a standardized way to compare the cost of borrowing.

Does the APR Calculator show the monthly EMI?

Yes ToolAndGame.com APR Calculator show the monthly EMI