💼 Business Loan Calculator

Business Loan EMI Calculator

To successfully build and expand a business, securing adequate capital is essential. Business loans serve as a reliable solution to meet various financial needs, from scaling operations to managing cash flow.

💼 Why Consider a Business Loan?

Business loans offer several advantages that can support your company’s growth and stability:

- Build Creditworthiness: Timely repayments can enhance your business credit score, facilitating future financing.

- Access to Capital: Provides the necessary funds for expansion, equipment purchases, or entering new markets.

- Flexible Terms: Many lenders offer customizable repayment plans to align with your business’s cash flow.

- Retain Ownership: Unlike equity financing, loans allow you to maintain full control over your business. Small Business Administration

How to Use the Business Loan EMI Calculator?

- Choose the amount that you need for your business

- Enter the interest rate offered depending on your business type

- Select a convenient loan tenure

- Press the ‘Calculate’ button.

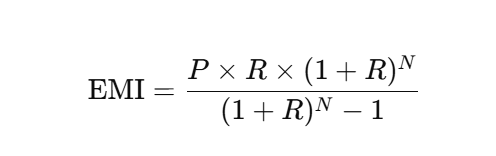

🧮 EMI Calculation Formula Explained

To calculate your Equated Monthly Installment (EMI), you can use the following formula:

Where:

- P = Principal loan amount

- R = Monthly interest rate (annual interest rate divided by 12)

- N = Total number of monthly installments (loan tenure in months)

This formula calculates the fixed monthly payment required to repay both the principal and interest over the loan tenure. It ensures that each installment covers the interest for the period and a portion of the principal, resulting in a consistent payment schedule throughout the loan duration.

📌 Example Calculation

Let’s Ravi has taken a loan of ₹1,00,000 at an annual interest rate of 8% for a tenure of 5 years (60 months).

First, convert the annual interest rate to a monthly rate:

- Annual Interest Rate = 8%

- Monthly Interest Rate (R) = 8% / 12 = 0.6667% = 0.006667

Now, plug the values into the EMI formula:

- P = ₹1,00,000

- R = 0.006667

- N = 60

EMI = [100000 × 0.006667 × (1 + 0.006667)^60] / [(1 + 0.006667)^60 – 1]

Calculating this gives an EMI of approximately ₹2,027.64 per month.

FAQs

What are the factors that affect business loan calculation?

Loan Amount: This is the most important aspect and the foundation for calculating monthly loan payments. The EMI amount tends to change according to the loan amount

Rate of Interest: This is a critical component that is established by your income, credit score, business financial statements, and payback capability.

Loan Tenure: The loan tenure has the greatest influence on the EMI amount because it is the period required to repay the total loan amount plus interest. An increase in tenure results in a lower EMI amount.

Is it necessary to log in to use the Business Loan EMI Calculator?

No, you do not need to log in or sign up to use the Business Loan EMI Calculator. It is completely free and accessible to everyone.

Can I change the loan amount, interest rate, or tenure to see different EMI options?

Yes, you can easily adjust the loan amount, interest rate, or tenure in the calculator to compare different EMI options and choose the most suitable plan for your business.

Can I use the Business Loan EMI Calculator on mobile?

Yes, the calculator is mobile-friendly and works smoothly on any device