🚚Commercial Vehicle Loan EMI Calculator

How to Use the Commercial Vehicle EMI Calculator?

- Choose the amount that you need for your Commercial vehicle as a loan

- Enter the interest rate offered to you

- Select a convenient loan tenure

- Press the ‘Calculate EMI’ button.

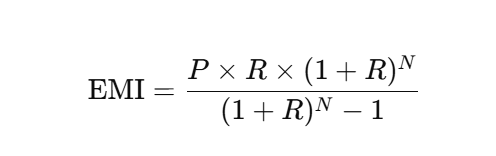

🧮 EMI Calculation Formula Explained

Here, P, R, and N are the key variables. This means the EMI amount will vary each time you adjust any of these three. Let’s understand them in detail:

P refers to the Principal Amount — the original loan amount provided by the bank, on which the interest is calculated.

R stands for the Rate of Interest determined by the bank.

N represents the Number of Years allotted for loan repayment. Since EMIs are paid monthly, the tenure is converted into the number of months.

For Example: If you take a car loan of Rs 50 lakh at an interest rate of 15%, for period of 10 years

the approximate EMI will be:

P = Rs 50,00,000, R = 15 ÷ 12 ÷ 100 = 0.012 (or 1%) , N = 10 years or 120 months. as per the formula

EMI = [5000000 x 0.012 x (1+0.012)^120] / [(1+0.01)^120 -1]

EMI = Rs 80667.48

Other Finance Tools:

- Gratuity Calculator

- National Savings Certificate (NSC) Calculator

- PPF Calculator

- Step-Up SIP Calculator

- Loan Foreclosure Calculator

FAQs

What is an EMI?

EMI (Equated Monthly Instalment) is a fixed payment that the borrower makes to the lender for a specified number of months or years

Which one is better, Commercial Vehicle EMI Calculator or Excel Calculator?

The Commercial Vehicle Loan EMI Calculator is specifically designed to compute Commercial Vehicle Loan EMIs within seconds. It is much simpler and more convenient to use compared to an Excel calculator.

Do I need to log in to use the Commercial Vehicle Loan EMI Calculator tool?

No, you do not need to log in to use the Commercial Vehicle Loan EMI Calculator. It is completely free and accessible without any registration.

Does the calculator provide total repayment details?

Yes, it shows your total interest payable and total repayment amount.

Will the EMI for commercial vehicle change if I change the interest rate or tenure?

Yes, any change in loan parameters will update your EMI instantly.