Debt Evaluation Calculator

A Debt Evaluation Calculator helps users understand their current debt situation and assess their financial health. It evaluates how much of your income goes toward debt repayment and helps determine whether your debt load is manageable or excessive.

In this calculator we not only provide Debt-to-Income ratio, but we also provide Savings Ratio and Expense Ratio in the same tool

How to use Debt Evaluation Calculator

- Enter your monthly debt payments.

- Enter your gross monthly income.

- The calculator instantly provides your Debt-to-Income Ratio (DTI).

- It gives you an indication of whether your debt is low, manageable, or high-risk.

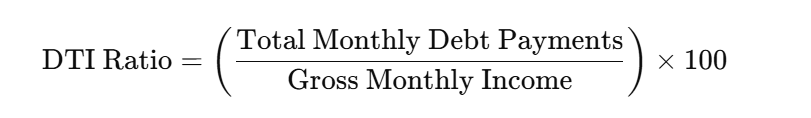

Key Formula Used: Debt-to-Income Ratio (DTI)

The most commonly used formula in debt evaluation is the Debt-to-Income (DTI) Ratio.

Total Monthly Debt Payments: Includes EMIs for loans, credit card bills, mortgage, car loans, etc.

Gross Monthly Income: Your income before tax and deductions (salary, business income, etc.).

Example:

Mangesh has a salary of ₹35000 he had an Home Loan and Car Loan so his total EMI was of ₹15000 so

DTI = (15000/35000)* 100;

so DTI (Debt-to-Income) ratio would be 42.86%

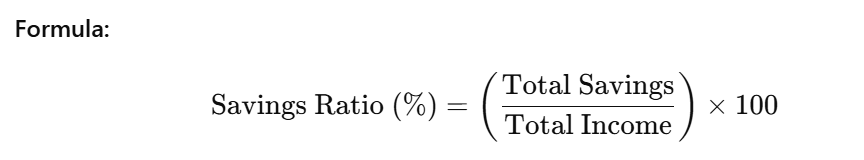

Key Formula Used: Savings Ratio

Example:

Mangesh has a salary of ₹35000 he had an Home Loan and Car Loan so his total EMI was of ₹15000 and his monthly savings is ₹4000

Savings Ratio = (4000/35000) * 100;

Savings Ratio = 11.43%

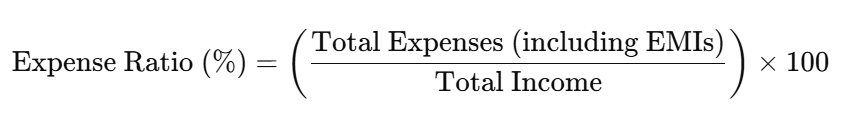

Key Formula Used: Expense Ratio

Example:

Mangesh has a salary of ₹35000 he had an Home Loan and Car Loan so his total EMI is of ₹15000, his monthly savings is ₹4000, at last his living expenses is ₹15000

Total Expenses = (15000 + 15000)

Total Expenses = ₹30000.

Expense Ratio = (Total Expenses/ Total Income)* 100;

Expense Ratio = (30000/35000)*100;

Expense Ratio = 85.71%

Other Finance Tools:

FAQs

What is a good Debt-to-Income (DTI) Ratio?

A DTI below 35% is generally considered good.

Between 36–43% is manageable.

Above 43% may be risky and could impact loan approvals.

Do I need to log in to use this calculator?

No, it’s free and doesn’t require any login or registration.

Should I include household expenses like groceries or utilities?

No. Only include fixed debt obligations, not living expenses.

What is a healthy debt-to-income (DTI) ratio?

A DTI ratio below 30% is considered healthy. It shows you are managing debt responsibly.

How do I reduce my debt ratio?

You can:

1. Pay off high-interest loans first

2. Avoid taking new credit

3. Increase income while keeping EMIs stable