🎓 Education Loan EMI Calculator

How to Use the Education Loan EMI Calculator?

- Choose the amount that you need for your Education as a loan

- Enter the interest rate offered to you

- Select a convenient loan tenure

- Press the ‘Calculate EMI’ button.

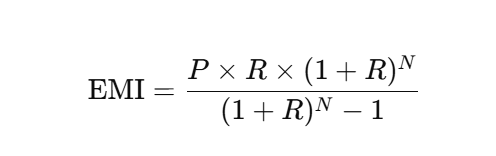

🧮 EMI Calculation Formula Explained

Here, P, R, and N are the key variables. This means the EMI amount will vary each time you adjust any of these three. Let’s understand them in detail:

P refers to the Principal Amount — the original loan amount provided by the bank, on which the interest is calculated.

R stands for the Rate of Interest determined by the bank.

N represents the Number of Years allotted for loan repayment. Since EMIs are paid monthly, the tenure is converted into the number of months.

Example:

Shambhavi want to pursue Medical after her 10th so she went to the bank and enquired for the education loan. So there she came to know about that in India banks provide education loan form female with less interest rate as compared to the male candidates so she applied for the education loan of 8,00,000 with the interest rate of 7.25 for the period of 8 years

First, convert the annual interest rate to a monthly rate:

- Annual Interest Rate = 7.25%

- Monthly Interest Rate (R) = 7.25% / 12 = 0.604% = 0.00604

Now, plug the values into the EMI formula:

- P = ₹8,00,000

- R = 0.00604

- N = 96

EMI = [800000 × 0.00604 × (1 + 0.00604)^96] / [(1 + 0.00604)^96 – 1]

Calculating this gives an EMI of approximately ₹11006.77 per month.

FAQs

Who is eligible for an Education Loan?

The banks and financial institutions mention the criteria for applying for an education loan. You can check a tab named “ Eligibility ” for that particular education loan. Here, a student’s merit and earning potential is also a factor.

What is covered in an educational loan?

An education loan generally covers tuition fees, examination fees, hostel charges, library and lab fees, cost of books, travel expenses (for studying abroad), and other education-related costs.

Is there a moratorium period on educational loans?

Yes, most educational loans offer a moratorium period, during which you don’t have to repay the loan. Typically, this includes the course duration plus 6 to 12 months after completing the course. which differs as per your loan provider

Is collateral required for an education loan?

Collateral is generally required for higher loan amounts. However, for smaller loans (usually up to ₹7.5 lakh in India), many banks provide unsecured education loans.

Is it possible to calculate the EMI on education loans without using this calculator?

Yes, you can calculate the EMI on educational loans manually using the standard EMI formula. However, it can be complex and time-consuming. Using an Educational Loan EMI Calculator makes the process much faster, easier, and more accurate.