FD Calculator

An FD Calculator helps you determine the maturity amount and interest earned on a fixed deposit over a given tenure, based on the principal amount, interest rate, and compounding frequency.

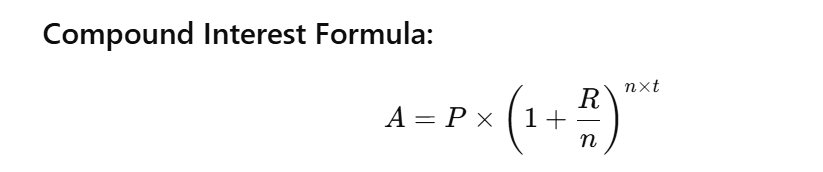

Compound Interest Formula (most commonly used by banks):

Where:

- A = Maturity Amount

- P = Principal (Initial Deposit)

- r = Annual Interest Rate (in decimal)

- n = Number of compounding periods per year

- t = Time (in years)

Interest Earned = A – P

Example:

Aman has a FD of ₹1,00,000 for 3 years at 6% rate of interest and n that bank the compounding frequency is quarterly so the maturity amount earned is ₹119556 after that total interest earned is

Interest Earned = 119556 – 100000 = ₹19,556

Steps to Use FD Calculator

- Enter the Principal Amount.

- Enter the Time Duration (in months/years).

- Enter the Interest Rate (% per annum).

- Choose the Compounding Frequency (Yearly, Quarterly, Monthly).

- Click Calculate and observe

Other Finance Tools:

FAQs

What is a Fixed Deposit (FD)?

A fixed deposit is a savings instrument offered by banks where you deposit money for a fixed tenure and earn guaranteed returns at a fixed interest rate.

Is the interest earned on FD taxable?

Yes, interest earned above ₹40,000 in a financial year (₹50,000 for senior citizens) is subject to TDS under Section 194A of the Income Tax Act.

What are the compounding frequency options?

Interest on FDs may be compounded:

Annually, Quarterly, Monthly

Is the interest compounded in Fixed Deposits?

Yes, most FDs compound interest quarterly, but some may offer monthly or yearly compounding.

Can I change the compounding frequency in the calculator?

Yes, most calculators allow you to choose between quarterly, monthly, semi-annual, and annual compounding.

Is it safe to invest in FDs?

Yes, FDs are generally considered low-risk investments, especially those held with reputed banks and institutions. In India, deposits up to ₹5 lakh are insured by DICGC.