Recurring Deposit Calculator

📌 Introduction

A Recurring Deposit (RD) Calculator helps you estimate the maturity value and interest earned on your monthly deposits. RDs are a popular savings option offered by banks and post offices, allowing you to deposit a fixed amount every month for a chosen tenure, earning interest at a fixed rate. This calculator saves you time by automatically computing the total investment, interest, and maturity value—helping you plan your savings better.

Formula for RD Maturity Value

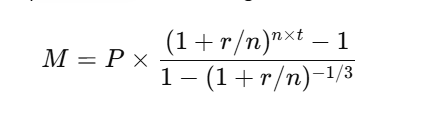

The maturity value of a Recurring Deposit is calculated using the formula:

Where:

- M = Maturity Value

- P = Monthly Deposit Amount

- r = Annual Interest Rate (in decimal)

- n = Number of compounding periods per year (usually 4 for quarterly compounding)

- t = Tenure in years

📊 Example

Monthly Deposit: ₹5,000

Annual Interest Rate: 6%

Tenure: 3 years

- Convert rate to decimal: 6% = 0.06

- n = 4 (quarterly compounding)

- Plug into the formula:

Result:

- Maturity Value ≈ ₹1,95,651

- Total Interest Earned ≈ ₹15,651

FAQs

Q1. What is a Recurring Deposit?

A. Recurring Deposit is a savings scheme where you invest a fixed amount every month for a specific tenure at a fixed interest rate.

Q2. Can I change my monthly deposit amount?

A. No, the deposit amount in an RD remains fixed throughout the tenure.

Q3. What happens if I miss an RD payment?

A. Banks may levy a penalty, and it could reduce your maturity value.

Q4. Is RD better than Fixed Deposit (FD)?

A. RD is better for disciplined monthly savings, while FD requires a lump sum investment at once.

Q5. Can I withdraw my RD before maturity?

A. Yes, but it may attract penalties, and the interest rate will be lower than the agreed rate.