🚗 Used Car Loan EMI Calculator

How to Use Used Car Loan EMI calculator

- Enter Loan Amount: Specify the amount you want to borrow for purchasing the 2-wheeler.

- Select Interest Rate: Input the annual rate of interest offered by your bank or lender.

- Choose Loan Tenure: Select the loan tenure in months.

- Click on “Calculate”: Once the details are filled in, click the “Calculate” button to see your monthly EMI and total repayment.

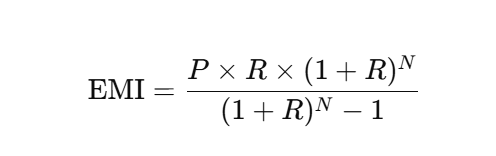

EMI Calculation Formula Explained

Here, P, R, and N are the key variables. This means the EMI amount will vary each time you adjust any of these three. Let’s understand them in detail:

- P refers to the Principal Amount — the original loan amount provided by the bank, on which the interest is calculated.

- R stands for the Rate of Interest determined by the bank.

- N represents the Number of Years allotted for loan repayment. Since EMIs are paid monthly, the tenure is converted into the number of months.

FAQs

Q1. What is a Used Car Loan EMI Calculator?

A. It’s a free online tool that helps you estimate the monthly EMI (Equated Monthly Installment) for a used car loan based on the loan amount, interest rate, and repayment tenure.

Q2. What details do I need to use this calculator?

A. You need to input:

a. Loan amount

b. Annual interest rate

c. Loan tenure (in months or years)

Q3. Are EMIs for used car loans higher than new car loans?

Yes, generally interest rates for used car loans are higher than new car loans, resulting in slightly higher EMIs.

Q4. Can I adjust the values to compare different EMI scenarios?

Yes, you can freely change the values of loan amount, interest rate, and tenure to see how your EMI varies.

Q5. Is this calculator suitable for all banks and NBFCs?

Yes, the calculator works for any lender. You just need to know your loan’s terms.