Post Office Monthly Income Scheme Calculator

The Post Office Monthly Income Scheme (POMIS) is a secure savings plan offered by India Post. It allows individuals to invest a lump sum and earn monthly interest payouts, making it ideal for regular income after retirement or for conservative investors.

Key Features of POMIS

- Interest Rate: 7.4% per annum (as of current quarter)

- Payout Frequency: Monthly

- Tenure: 5 years

- Minimum Investment: ₹1,000

- Maximum Limit:

- ₹9 lakh (individual account)

- ₹15 lakh (joint account)

Who Can Use Post Office Monthly Income Scheme?

- Senior citizens seeking a fixed monthly income.

- Conservative investors looking for secure returns.

- Parents saving in their child’s name (via a minor account).

Steps to Use the POMIS Calculator

- Enter your investment amount (between ₹1,000 and ₹9,00,000).

- Confirm the interest rate (pre-filled or adjustable).

- View your monthly income instantly based on the calculation.

- Optional: Calculate total interest earned at the end of 5 years .

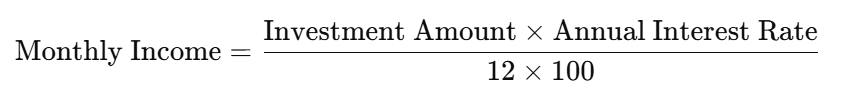

Formula to Calculate Monthly Income

Investment Amount = Amount Invested in

Annual Interest Rate = Rate of Interest

Example

If Priya invests ₹5,00,000 in POMIS at 7.4% p.a., her monthly income is calculated So, Priya will receive ₹3,083/month for the next 5 years.

FAQs

Can I open a POMIS account online?

No, currently, POMIS accounts must be opened at a post office in person.

Is the interest taxable?

Yes, monthly interest is taxable, but there is no TDS deducted by the post office.

Can I reinvest my monthly interest?

Yes, you can direct it into a Recurring Deposit or Savings Account.

Can I open a joint POMIS account?

Yes, up to 3 adults can open a joint account, and the maximum investment increases to ₹15 lakh.

Is nomination facility available under POMIS?

Yes, you can nominate a beneficiary at the time of account opening or anytime later.

Can Non-Resident Indians (NRIs) invest in Post Office Monthly Income Scheme?

No, NRIs are not eligible to open or maintain a POMIS account.

Is it possible to extend the account after maturity?

No, the POMIS account cannot be extended. However, you can reinvest the maturity amount in a new POMIS account or other small savings schemes.