Senior Citizens Savings Scheme (SCSS) Calculator

Searching for a secure and rewarding investment option post-retirement? The Senior Citizens Savings Scheme (SCSS) is an ideal choice for individuals aged 60 years and above.

The Senior Citizens Savings Scheme (SCSS) Calculator helps individuals aged 60 and above estimate the interest earned and maturity amount on their SCSS investments. It’s a useful tool for planning post-retirement income with one of the safest government-backed savings options.

Who Can Use SCSS Calculator?

- You are a senior citizen aged 60 years or more.

- You are aged 55–60 years and retired under superannuation or VRS (within 1 month of retirement).

- You want to invest under the Senior Citizens Savings Scheme (SCSS).

Benefits of Using SCSS Calculator

- Saves Time: Quickly delivers the maturity and interest amounts—no need for manual math.

- High Accuracy: Eliminates calculation errors and provides dependable, precise results.

- User-Friendly: Designed with a simple interface, making it easy for all age groups to use.

- Smart Financial Planning: Helps you assess if SCSS suits your retirement income goals.

- Effective Comparison: Lets you compare SCSS returns with other saving options to make informed choices.

Where and How to Invest in SCSS

Where to Open an SCSS Account:

You can open a Senior Citizens Savings Scheme account at the following authorized institutions:

- Post Offices (across India)

- Public Sector Banks (e.g., SBI, Bank of Baroda, PNB)

- Select Private Banks authorized by the Government of India

Steps to Open an SCSS Account:

- Visit a nearby post office or authorized bank branch.

- Collect and fill out the SCSS account opening form (Form A).

- Attach required documents:

- Proof of age (Aadhaar, PAN card, passport, etc.)

- Identity and address proof

- 2 passport-sized photographs

- Submit the form along with the deposit amount (cheque or cash) — minimum ₹1,000, up to ₹30 lakh.

- Receive the account passbook or confirmation slip after successful processing.

Steps to Use the SCSS Calculator

- Enter your Principal Amount ie.(investment amount)

- Enter the interest rate

- The tool automatically assumes a 5-year tenure.

- Click Calculate.

- View your total interest, and maturity amount.

- Use Reset to try different inputs.

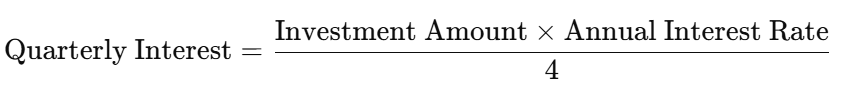

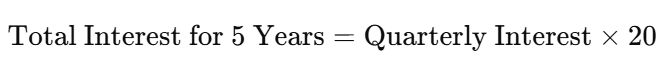

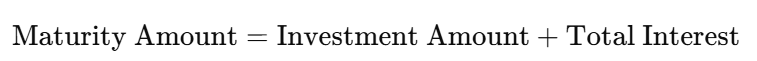

Formula

- Investment Amount = Initial deposit

- Annual Interest Rate = Current SCSS Interest rate

- Quarterly Interest = Paid every 3 months

- 20 = Number of quarters in 5 years

- Total Interest = Interest earned in 5 years

- Maturity Amount = Investment and Total Interest

Example:

Navin invests in ₹1,00,000 in SCSS at 8.2% p.a.

- Quarterly Interest = (10,00,000 × 8.2%) / 4 = ₹20,500

- Total Interest in 5 Years = ₹20,500 × 20 = ₹4,10,000

- Maturity Amount = ₹10,00,000 + ₹4,10,000 = ₹14,10,000

FAQs

What is the current SCSS interest rate?

It is revised quarterly by the government. As of Q1 FY 2025, it’s around 8.2% p.a.

Is the interest compounded in SCSS?

No. SCSS pays simple interest quarterly.

What is the maximum investment allowed in SCSS?

The limit is ₹30 lakh (as updated in recent government notifications).

Can I extend my SCSS account?

Yes, after 5 years, you can extend it once for 3 more years.

Can I open more than one SCSS account?

Yes, an individual can open more than one SCSS account, but the total investment across all accounts should not exceed ₹30 lakh.

What is the minimum and maximum investment allowed under SCSS?

The minimum investment is ₹1,000 (in multiples of ₹1,000), and the maximum limit is ₹30 lakh (as per the latest government update).