Sukanya Samriddhi Yojana Calculator

Sukanya Samriddhi Yojana (SSY) is a savings scheme launched back in 2015 as part of the Government initiative Beti Bachao, Beti Padhao campaign. The Sukanya Samriddhi Yojana Calculator is a financial tool that helps you estimate the maturity amount and total interest earned under the SSY scheme.

Benefits of Sukanya Samriddhi Yojana

- High Interest Rate

- Tax Benefits (Exempt-Exempt-Exempt Status)

- Small Investment Requirement

- Long-Term Financial Planning for Girl Child

- Partial Withdrawal Facility as girl turns 18

- One Account per Girl Child

- Lock In period of 21 years from the date of account opening

SSY Interest Rate (as of Q1 FY 2025–26)

- Interest Rate: 8.2% per annum (compounded annually)

- Interest is revised every quarter by the Ministry of Finance.

How to Use the SSY Calculator

- Enter the Yearly Investment

- Enter the interest rate currently it is 8.2%

- Click on Calculate

How to Open an SSY Account

- Visit any Post Office or authorized public/private bank.

- Fill the SSY Account Opening Form.

- Provide required documents:

- Girl child’s birth certificate

- Parent/guardian’s ID and address proof

- Deposit at least ₹250 to activate the account.

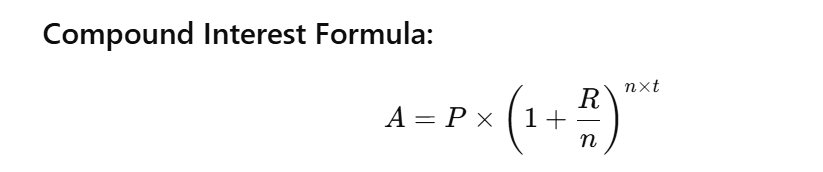

Formula Used:

- A = Maturity Amount

- P = Annual Contribution

- r = Interest Rate (currently 8.2% as of FY 2024-25 Q1)

- n = Number of Years

FAQs

Can both parents open SSY accounts for the same child?

No. Only one account per girl child is allowed.

Can the account be transferred?

Yes. Between post offices and banks within India.

How many SSY accounts can be opened per family?

A maximum of two accounts for two girl children. A third account is allowed only in the case of twins/triplets.

What happens if I miss a year’s deposit?

A penalty of ₹50/year applies. The account can be reactivated by paying the missed deposit + penalty.

Can an SSY account be closed before maturity?

Yes, a Sukanya Samriddhi Yojana account can be closed in the event of the account holder’s death or for the treatment of life-threatening illnesses, subject to approval from the Central Government.

Is premature withdrawal allowed?

Yes, partial withdrawal (up to 50% of the balance) is allowed after the girl turns 18 years, for education or marriage expenses.

What if the girl gets married before 21 years?

The account must be closed once the girl gets married after the age of 18. No interest will be paid after that.

Is there any risk of losing money in SSY?

No. SSY is a government-backed scheme with sovereign guarantee, making it one of the safest investment options for children.