🏍️ Two-Wheeler Loan EMI Calculator

Owning a Two-wheeler (Bike, Scooter) is an essential mode of transportation, especially in busy cities. With flexible loan options, you can now own your dream motorcycle or scooter with manageable EMIs, without straining your budget. Use our 2-Wheeler Loan Calculator to make informed decisions and choose the best loan plan for you!

What is a two-wheeler loan EMI calculator?

Our Bike Loan EMI Calculator is a handy tool designed to help you easily calculate the EMI (Equated Monthly Installment) for your two-wheeler loan. Whether you’re purchasing a motorcycle or scooter, this tool provides an estimate of your monthly payments based on your loan details

The below three variables are necessary to utilize a two-wheeler loan EMI calculator:

Loan Principal:- This is the amount you borrow and must repay over time, together with any applicable interest.

Interest Rate:- The rate at which interest is charged on the principal loan amount.

Loan Tenure:-It refers to the time frame in which the loan amount, and interest, must be returned in equal monthly instalments (EMIs).

How to Use Bike loan EMI calculator

- Enter Loan Amount: Specify the amount you want to borrow for purchasing the 2-wheeler.

- Select Interest Rate: Input the annual rate of interest offered by your bank or lender.

- Choose Loan Tenure: Select the loan tenure in months.

- Click on “Calculate”: Once the details are filled in, click the “Calculate” button to see your monthly EMI and total repayment.

- View Results: Review the EMI, total repayment, and interest payable for your loan.

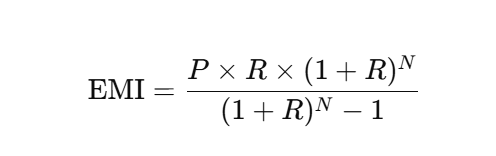

🧮 EMI Calculation Formula Explained

Here, P, R, and N are the key variables. This means the EMI amount will vary each time you adjust any of these three. Let’s understand them in detail:

P refers to the Principal Amount — the original loan amount provided by the bank, on which the interest is calculated.

R stands for the Rate of Interest determined by the bank.

N represents the Number of Years allotted for loan repayment. Since EMIs are paid monthly, the tenure is converted into the number of months.

Example:

Varun has a bike loan of ₹1,00,000 at an annual interest rate of 8.5% for a tenure of 2 years

P = ₹1,00,000, R = 8.5 / 12 / 100 = 0.00708, N = 2 × 12 = 24

Calculation as per formula

Total Payment (Principal + Interest): ₹108545.50, Monthly EMI: ₹4522.73

Other Finance Tools:

FAQs

Can I change the loan amount, interest rate, or tenure to see different EMI options?

Yes, you can easily adjust the loan amount, interest rate, or tenure in the calculator to compare different EMI options and choose the most suitable plan for your business.

Is this Two-Wheeler Loan EMI Calculator free to use?

Yes, It is absolutely free to use and it does not requires you to login.

Can I use the Two-Wheeler Loan EMI Calculator on mobile?

Yes, the calculator is mobile-friendly and works smoothly on any device

Does the calculator include taxes and other charges?

No. The calculator only estimates EMI based on principal, interest, and tenure. registration, or processing fees are not included.

Can I prepay my two-wheeler loan? Will it affect EMI?

Yes, most banks allow prepayment. It can reduce your overall interest burden or shorten your loan tenure, but it may not change your EMI unless the lender agrees to restructure.

What is the ideal loan tenure for a two-wheeler (Bike or Scooter) loan?

Tenure typically ranges from 6 to 60 months. A shorter tenure means higher EMIs but lower total interest, while a longer tenure reduces EMI but increases total interest paid.

Can I use this calculator for electric two-wheelers as well?

Yes, the EMI calculator works for both conventional and electric two-wheelers, as long as you know the loan amount, rate, and tenure.

Does the calculator provide an amortization schedule?

Basic calculators show monthly EMI and total interest. Some advanced ones may show amortization calculator schedules—how much goes toward principal and interest each month.