🏠 Mortgage Payoff Calculator

Current Monthly Payment (₹): 0.00

A Mortgage Payoff Calculator helps you determine how quickly you can pay off your home loan by making extra payments. It shows how additional contributions toward your principal can reduce your loan term and save you significant interest over time.

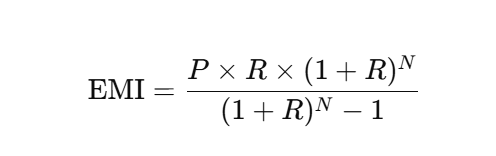

The core formula for the remaining loan balance and payoff time is based on the standard EMI equation:

Monthly Payment (EMI)

Where:

- N = Loan Tenure in Months

- P = Loan Amount (Principal)

- R = Monthly Interest Rate (Annual Rate ÷ 12 ÷ 100)

When extra payments are made, the remaining principal is recalculated after each payment, which shortens N (loan term) instead of reducing EMI.

Example

Loan Details:

- Principal (P) = ₹50,00,000

- Annual Interest Rate = 7% → Monthly (R) = 0.005833

- Tenure (N) = 240 months (20 years)

- Extra Monthly Payment = ₹5,000

EMI without extra payments = ₹38,765

By adding ₹5,000 each month, the loan term reduces to about 201 months, saving ₹7,58,000 in interest.

Other Finance Tools:

- Amortization Calculator

- Home Loan EMI Calculator

- Gold Loan Calculator

- Education Loan EMI Calculator

- Commercial Vehicle Loan Calculator

FAQs

What is a Mortgage Payoff Calculator?

A mortgage payoff calculator helps you estimate how long it will take to repay your home loan based on your loan amount, interest rate, and any extra monthly payments.

How can I use this tool to pay off my mortgage faster?

By entering an additional monthly payment, the calculator shows how much sooner you can repay your loan and how much interest you can save.

What details do I need to use the calculator?

You need your loan amount, annual interest rate, loan term (in years), and any extra amount you plan to pay monthly.

Can I include a lump sum payment in this calculator?

This version supports monthly extra payments. For lump sum inclusion, you can request a custom version.

Is this calculator suitable for other types of loans?

It is primarily designed for mortgages but can also be used for any amortized loan with fixed monthly payments.